Despite the fact that Required Minimum Distributions (RMDs) impact everyone above age 70.5 with a tax-deferred investment account balance, there is still a surprising amount of confusion around the subject of RMDs and how to calculate the distribution required. Before I get to the actual calculation, I’ll briefly address some frequently asked questions about RMDs many retirees may be curious about.

What is an RMD?

This is the mandatory minimum withdrawal that must be taken from tax-deferred retirement accounts starting the year you turn age 70.5. You can always take more than your RMD amount, but as I’ll discuss, you’ll want to ensure you take the minimum.

What is a tax-deferred retirement account?

This can be a Traditional IRA, 401(k) or 403(b) account and therefore require distributions. Roth IRAs and Taxable Accounts (Joint, Single, Trust) do not require distributions.

Please note that Roth 401ks/403bs DO require RMDs, though those distributions are not taxable. If you roll those Roth 401k/403b balances to a Roth IRA, you can avoid the RMD requirement altogether.

Why do you have to take money out?

This probably won’t surprise you, but the federal government wants “their” money. Because they’ve allowed you to defer your taxes, they have not received a penny in taxes for the term of the deferral. By mandating that you take money out of the account, you will recognize income and by extension, they will get “their” portion.

What if I don’t take my RMD?

If you forget to take your RMD or for whatever reason don’t take it on time, you will be faced with one of the steepest penalties the IRS levies - an excise tax (penalty) of 50% of the required distribution amount. For example, if your RMD is $40,000 and you fail to take it, the IRS will levy a penalty of $20,000.

What if I already missed my RMD?

If you’ve missed your RMD due to a “reasonable error,” you can apply for a waiver of the 50% penalty by filing Form 5329. You will want to include a letter of explanation including the steps you’ve taken to remedy the situation. Investopedia has a helpful guide on what to do that can be found here.

Do I have to withdraw the RMD in a single lump sum?

No, you do not. You can take it in a lump sum if you desire to do so, or you can take it in monthly or quarterly distributions or any way that works for you and your lifestyle. The key is to take out the amount required during the calendar year required.

What is the deadline for taking RMDs?

Your first RMD can be delayed until April 15th of the year following the year you turn 70.5. For every subsequent year, the deadline is December 31st.

Be careful if you choose to delay your first RMD to the following tax year - if you do this, you will be required to take two distributions in the same year. This could push you into a higher tax bracket and cause you to pay higher Medicare premiums also. This is an additional “tax” that most people never consider, so be cognizant of your tax situation as you begin RMDs.

What if I have tax-deferred accounts all over, can I make the required distribution from just one account?

If you have multiple Traditional IRAs, yes you can consolidate your distributions to be distributed from just one account. But if you have 401ks (or other types of tax-deferred accounts), you will need to calculate and satisfy the RMD requirement for each account separately.

Because the penalties are steep for any mistakes, this is one reason it is often easier to consolidate your tax-deferred accounts to a single IRA to simplify your overall RMD situation.

How to calculate your Required Minimum Distribution:

As much confusion as there is surrounding the topic, the RMD calculation is actually one of the easier calculations within the IRS tax code. It is a one-step calculation. You divide your cumulative tax-deferred balance as of 31 December of the prior year by your life expectancy as defined by the IRS Uniform Life Expectancy Table.

NOTE: If your spouse is more than 10 years younger than you and is the sole beneficiary of your tax-deferred account, you would use the Joint Life and Last Survivor Expectancy Table. This will result in a lower RMD amount.

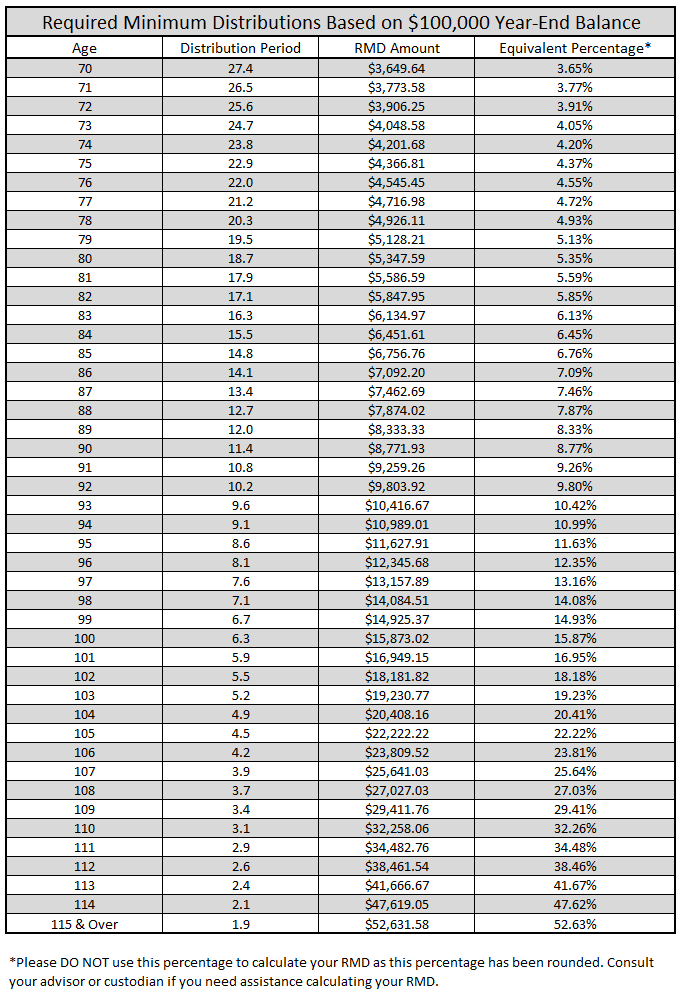

Before I get to the table, here is an example using the Uniform Life Expectancy Table to help you understand the calculation. If you were age 72 at year-end and had a $100,000 tax-deferred balance, you would simply divide the $100,000 by 25.6 to arrive at your Required Minimum Distribution. See

$100,000 / 25.6 = $3,906.25

Below, I’ve converted the withdrawal to an estimated *equivalent* percentage. Please note as I do in the footnote below the table, do not use this percentage to complete your RMD calculation as it will not provide the EXACT amount

Here are the estimated Required Minimum Distributions based on a $100,000 prior year-end balance. The age is

If you’re looking for an easy-to-use calculator to calculate your RMD, FINRA has a great one. Check it out here.

Hope this helps clear up some of the confusion. Be sure to verify that you’ve successfully accounted for all accounts requiring distributions to ensure you don’t pay unnecessary penalties. If you have questions, contact your financial advisor or another qualified professional to help. Or feel free to reach out to me with any other questions I haven’t addressed here.

Thanks for reading!

Ashby Daniels

I am a Pittsburgh Financial Advisor that specializes in working with people transitioning into retirement. If you’d like more information, see Who We Serve. Or to contact me, go here.

Disclaimer: RMDs are generally subject to federal income tax and may be subject to state taxes. Consult your tax advisor to assess your situation.