As I sat with a friend the other night, the conversation came up as to what he should do with all the negative market news as he indicated to me that he had a significant amount of funds on the sidelines. (Full disclosure: He said this conversation should be a blog post since it was this blog that opened the lines of communication.)

Conveniently, I’ve had a number of experiences over the past few years where clients have come into a lump sum to invest or where prospective clients have been introduced to me for similar reasons.

To be clear, this is not another post about the best strategy to invest a lump sum but on the feelings of investing a lump sum. I will discuss the strategy I’d utilize, but the important point here is the part about feelings.

Regardless of the source of funds, one thing I’ve found to be true across all lump sum investment opportunities is:

Now NEVER seems like a good time to invest your money.

If the market is near a peak, the fear is that the market is going to fall as soon as the money is invested. If the market is down, the fear is that the market is going to keep going down. The prevailing theme at any point is that the market is destined to go down. As a result, “Let’s wait and see what happens” is a common refrain as if the future market performance would offer any indication of the wisdom of the decision.

We can play the what-if game until we are blue in the face, but no matter the outcome of that hypothetical game, the key question isn’t about what is going to happen over the next week (or whatever time period) but, when will you need the money?

It’s quite simple in my opinion - any money you may need over the next few years (dependent on the person) should not be invested in the stock market. Any money that falls outside of that simple rule should be invested immediately in accordance with your agreed-upon investment allocation.

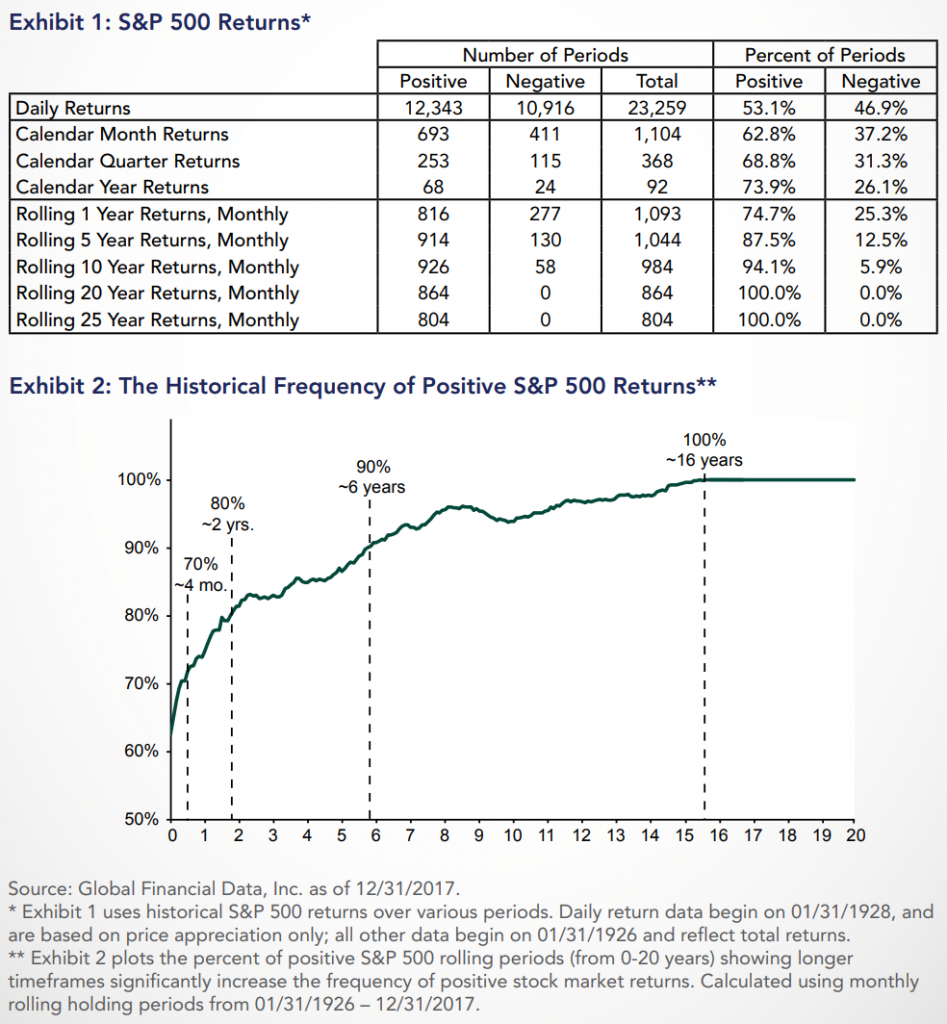

Why? The data is pretty clear on this from a statistical standpoint. Here’s the simplest way of looking at this…On a rolling basis, over any four-month period, there is a 70% probability of positive returns in the market and the numbers get better from there the further out you go.

It’s surprising even to me that over a short period of just four months, market returns are likely to be positive - to the tune of 70% of the time. Why would anyone want to bet against those odds? Casinos make millions by maintaining a very slight edge over gamblers yet we balk at the idea of investing dollars right away because we think we know what will happen next or are at least worried that we are going to make a timing mistake - in other words, a mistake that is both unknowable and entirely out of our control.

But surely there is an optimal way to do this, right? You’d be correct of course, but the problem is that any “optimal strategy” is based entirely on the past - data that is more or less useless to us unless it gives you some sort of emotional fortitude that you wouldn’t otherwise have. Said another way, we can’t possibly know what optimal is until the future gets here.

For example, if the market just goes up, then the optimal strategy would have been to invest 100% right away. If the market just falls, then the optimal strategy would have been to wait until the bottom and there are infinite situations in between that could happen. Long story short, optimal is only known via the rearview mirror and any strategy you abide by because it’s optimal is almost sure to NOT be optimal once the allotted time passes.

And I think it’s relevant to note that up to a point, we are optimizing for theoretical marginal gains. I believe we should optimize things that provide long-run significant benefits like asset allocation and not haggle over optimizations that are short-term in nature where outcomes are a crapshoot.

Because, as I wrote a few weeks back, nobody can see these things coming. People who came into a lump sum or panicked at the end of 2018 and wanted to (understandably) slowly dip their toes back into the waters of the market may have missed out on the majority of the benefits of 2019 - one of the best market performance years of the last forty years.

To be clear, it could have gone a different way as the market could have kept falling. And I’m not prognosticating what’s going to happen next, but to make a point that we cannot always equate the outcome of a decision to the quality of a decision. Sometimes, those two things diverge from one another - it’s the nature of life. The key is to make the best decision we can based on the information at hand.

If it provides any additional comfort, you may remind yourself that your retirement is likely to be a 30-year endeavor or more. Therefore, it is unlikely that any one-month, six-month, one-year or whatever span is going to ruin your retirement unless of course, you make an emotional decision in the throes of one of those scary periods. The best idea is to have a plan for your portfolio that might effectively provide income over a 30-year retirement.

To reiterate the primary point of this soap-box post: Putting your money into the market will NEVER feel like it’s quite the right time. It’s the nature of investing.

Thanks to my friend who spurred this conversation - you know who you are.

This post is not advice. Please see additional disclaimers.